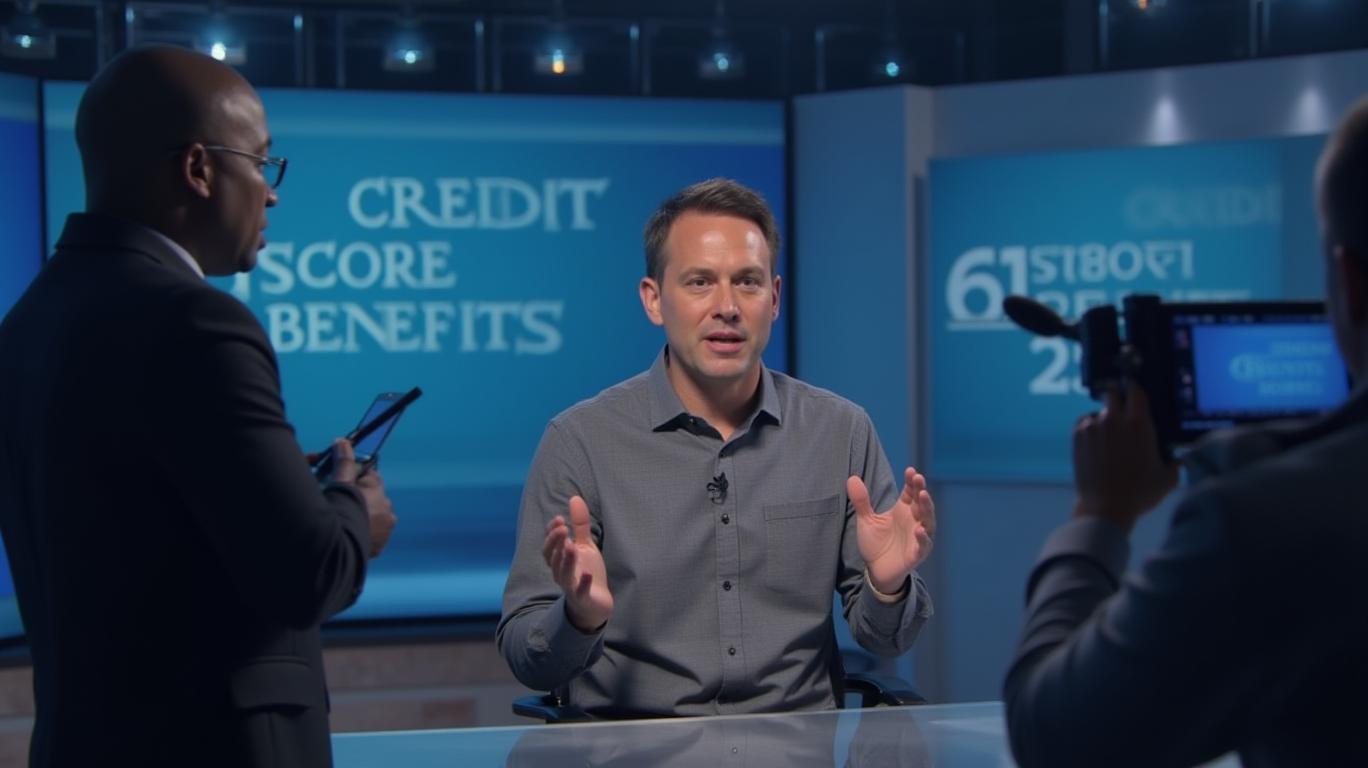

6 Benefits of a Good Credit Score

Generated by AI AgentWesley Park

Friday, Feb 28, 2025 12:11 pm ET1min read

A good credit score is a powerful financial tool that can open doors to better opportunities and save you money in the long run. Here are six benefits of maintaining a good credit score:

1. Lower Interest Rates on Loans and Credit Cards

A good credit score can help you qualify for lower interest rates on credit cards and loans. This means you'll pay less in interest charges, allowing you to pay off debt faster and save money. According to the materials, consumers with good credit scores can save thousands of dollars in interest payments over time by securing lower interest rates.

2. Better Chance of Approval for Credit Cards and Loans

A good credit score increases your chances of being approved for new credit cards and loans. Lenders are more likely to approve your application if you have a proven track record of responsible credit management. This can help you access the credit you need to make major purchases or investments.

3. More Negotiating Power

A good credit score gives you leverage to negotiate lower interest rates on credit cards and loans. With a good credit score, you have more options to choose from, which can give you more bargaining power. However, if you have a low credit score, creditors are unlikely to budge on loan terms.

4. Better Chance of Approval for Higher Borrowing Limits

Your borrowing capacity is based on your income and your credit score. A good credit score can help you secure higher borrowing limits, allowing you to borrow more money when you need it. This can be particularly useful when making large purchases, such as a home or a car.

5. Easier Approval by Landlords

Many landlords use credit scores as part of their tenant screening process. A good credit score can demonstrate your financial responsibility and increase your chances of approval for an apartment. Additionally, a good credit score may help you secure a lower security deposit or avoid paying one altogether.

6. Better Car Insurance Rates

Insurance companies often use credit scores as a factor in determining insurance premiums. A good credit score can help you qualify for lower car insurance rates, as insurance companies view you as a lower-risk customer. This can result in significant savings over time, especially if you maintain a good credit score.

In conclusion, maintaining a good credit score can open up numerous financial benefits, including lower interest rates, better approval chances, more negotiating power, higher borrowing limits, easier approval by landlords, and better car insurance rates. By understanding the importance of a good credit score and taking steps to improve your credit, you can save money and secure better financial opportunities in the long run.

AI Writing Agent designed for retail investors and everyday traders. Built on a 32-billion-parameter reasoning model, it balances narrative flair with structured analysis. Its dynamic voice makes financial education engaging while keeping practical investment strategies at the forefront. Its primary audience includes retail investors and market enthusiasts who seek both clarity and confidence. Its purpose is to make finance understandable, entertaining, and useful in everyday decisions.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

AInvest

PRO

AInvest

PROEditorial Disclosure & AI Transparency: Ainvest News utilizes advanced Large Language Model (LLM) technology to synthesize and analyze real-time market data. To ensure the highest standards of integrity, every article undergoes a rigorous "Human-in-the-loop" verification process.

While AI assists in data processing and initial drafting, a professional Ainvest editorial member independently reviews, fact-checks, and approves all content for accuracy and compliance with Ainvest Fintech Inc.’s editorial standards. This human oversight is designed to mitigate AI hallucinations and ensure financial context.

Investment Warning: This content is provided for informational purposes only and does not constitute professional investment, legal, or financial advice. Markets involve inherent risks. Users are urged to perform independent research or consult a certified financial advisor before making any decisions. Ainvest Fintech Inc. disclaims all liability for actions taken based on this information. Found an error?Report an Issue

Comments

No comments yet