S&P 500 Enters a Correction, History Says Buy the Dip?

The S&P 500 has dropped over 10% from its previous high, officially entering a technical correction zone. The Nasdaq is already in a pullback territory, and the Dow is just one step away from entering the same zone.

U.S. stocks have fully reversed the gains made since Trump's inauguration. Trump, who constantly talks about revitalizing the U.S. economy, has set an awkward record: U.S. stocks have seen seven sharp corrections since 1929 (a drop of more than 10% in less than two weeks), three of which (2018, 2020, and now) occurred during Trump's tenure. While the 2020 drop was a COVID-19 Black Swan event, the 2018 and current large corrections are entirely due to Trump's tariff policies.

The question now is whether U.S. stocks will continue to fall into a bear market or bottom out and rebound?

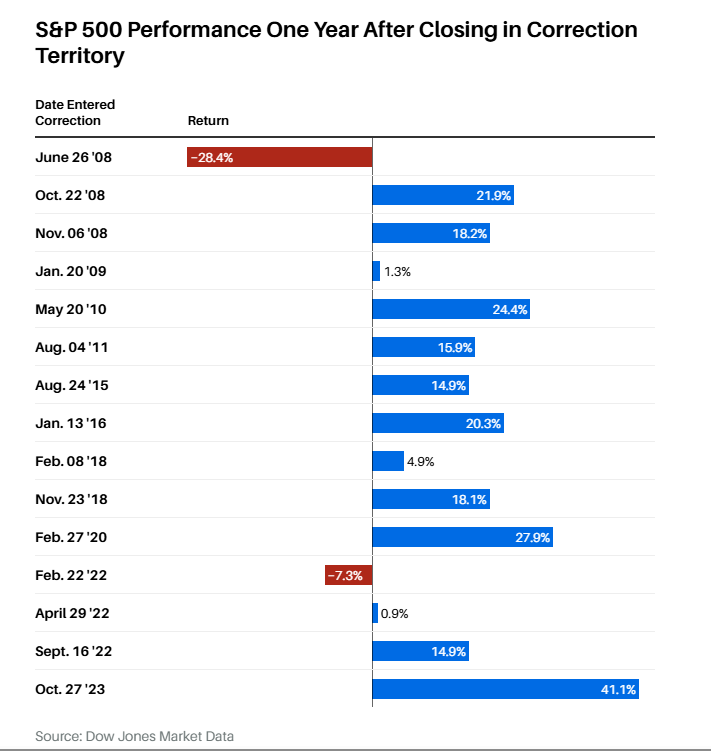

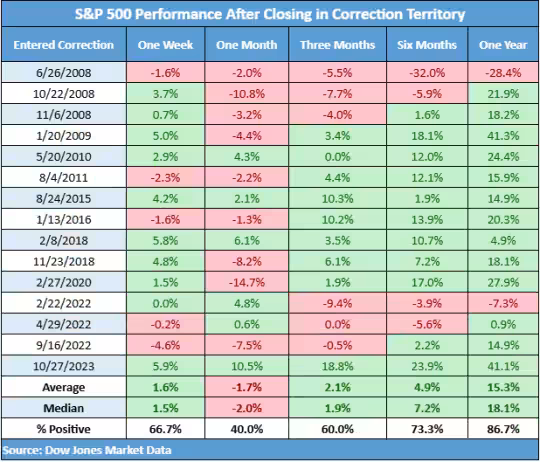

Let's look at history. Since 2008, U.S. stocks have experienced over a dozen technical adjustments (a drop of over 10% from a high). Looking at the long-term, if you bought on the day the adjustment was confirmed, only two instances recorded negative returns after a year; the rest had positive returns.

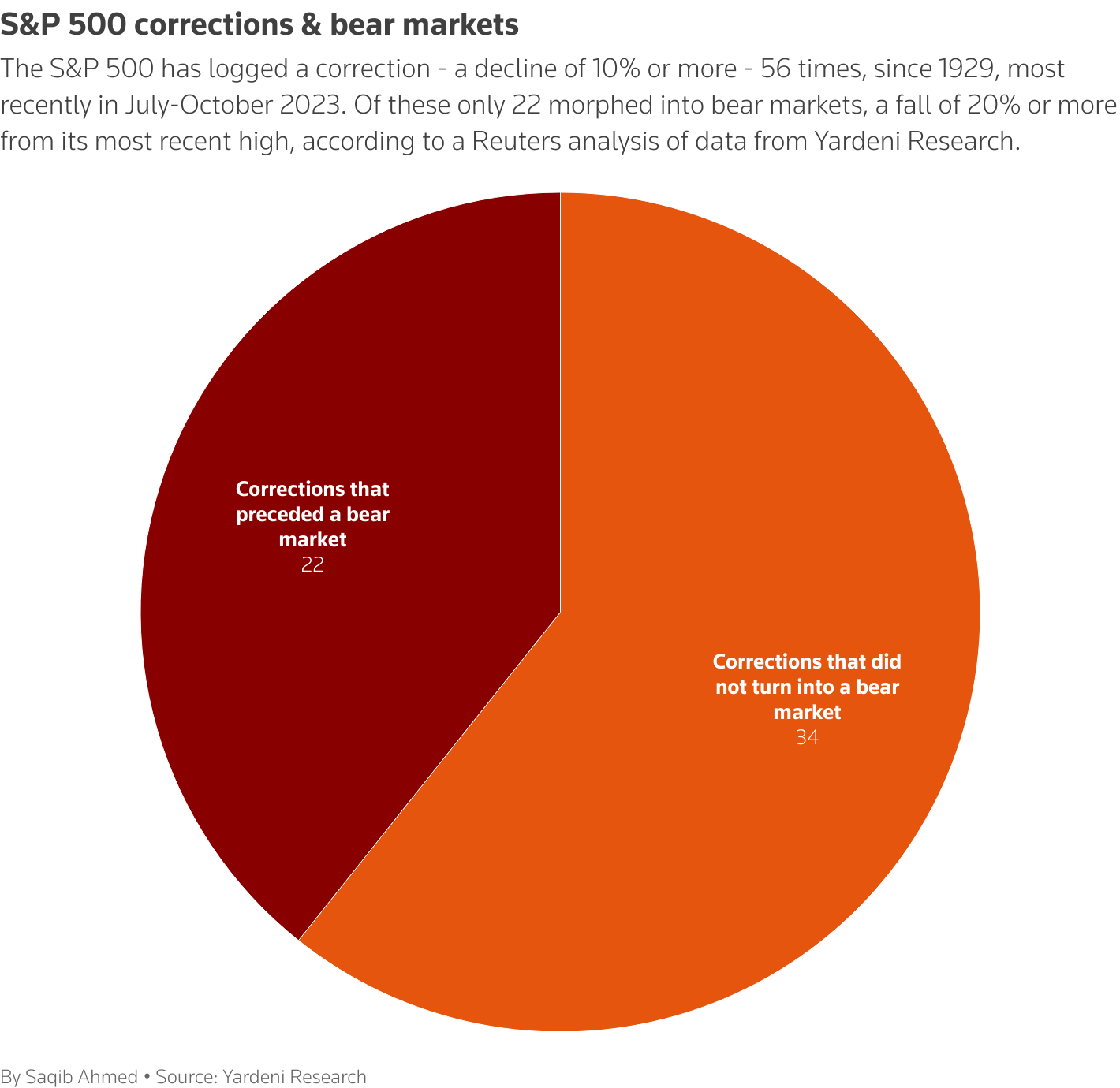

From a probability perspective, the odds are in favor of the bulls. Data shows that since 1929, the S&P 500 has entered correction territory 56 times, 22 of which turned into bear markets (40%), while 60% did not.

Following the recent correction, U.S. stock valuations are becoming more reasonable. The S&P 500's price-to-earnings ratio is currently 18, close to the five-year average, down from 23, its highest level before the correction.

Adjustments that didn't turn into bear markets had an average drop of 13.8%, while bear markets saw an average drop of 35.6%. This suggests that if the current correction doesn't push U.S. stocks into a bear market, a bottom might be near.

Analyst Views:

The Weitz Investment Management team believes that entering correction territory is common and happens once a year on average, lasting three to four months. Corrections that don't turn into bear markets typically see an average decline of 13%, with the market recovering after about four months. From a long-term perspective, stock market adjustments are just temporary fluctuations in a larger market trend.

John Kolovos, Chief Technical Strategist at Macro Risk Advisors, points out that a 10% correction typically takes two months, but this one only took about two weeks. The rapid decline suggests we are in a correction zone, not a new bear market. Market corrections are often short and sharp, while bear markets tend to be slower.

Rob Arnott, Founder and Chairman of Research Affiliates, says, "This should be a great buying opportunity, as small-cap and value stocks look very attractive. The undervalued stocks have suffered as much as the overvalued ones and have been clearly oversold."

Talley Léger, Chief Market Strategist at The Wealth Consulting Group, believes the current correction won't turn into a bear market. He notes that inflationary pressures are starting to ease, and corporate earnings growth will remain strong this year. Buying the dip is a good strategy, and he plans to increase his positions. From a probability standpoint, market corrections are healthy and will lead to better returns in the long run.

Barron's points out that the U.S. stock valuation pendulum has shifted from being historically expensive to a more reasonable range. While buying the dip may seem cliché, history has repeatedly proven that for long-term wealth-building investors, this approach is the right move.

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Stay ahead of the market.

Get curated U.S. market news, insights and key dates delivered to your inbox.

Comments

No comments yet